Why Speed Matters: Closing Deals in 10 Days

Speed is leverage in real estate lending. In a market where the best opportunities vanish in days, East West Lending Solutions closes in 10 days or less. Our AI-first platform and parallel processing workflow compress what takes other lenders 30–90 days into a predictable, repeatable, deal-winning advantage.

Why Traditional Lenders Can’t Keep Up

Most banks and conventional lenders are still operating in a linear process model—each stage starts after the last ends. That means 6–12 weeks of underwriting, document collection, legal review, and funding. In a market where:

- Sellers have multiple cash offers

- Rates can shift within days

- Premium properties are under contract in a week

…slower lenders simply price themselves out of the best deals.

How We Close in 10 Days

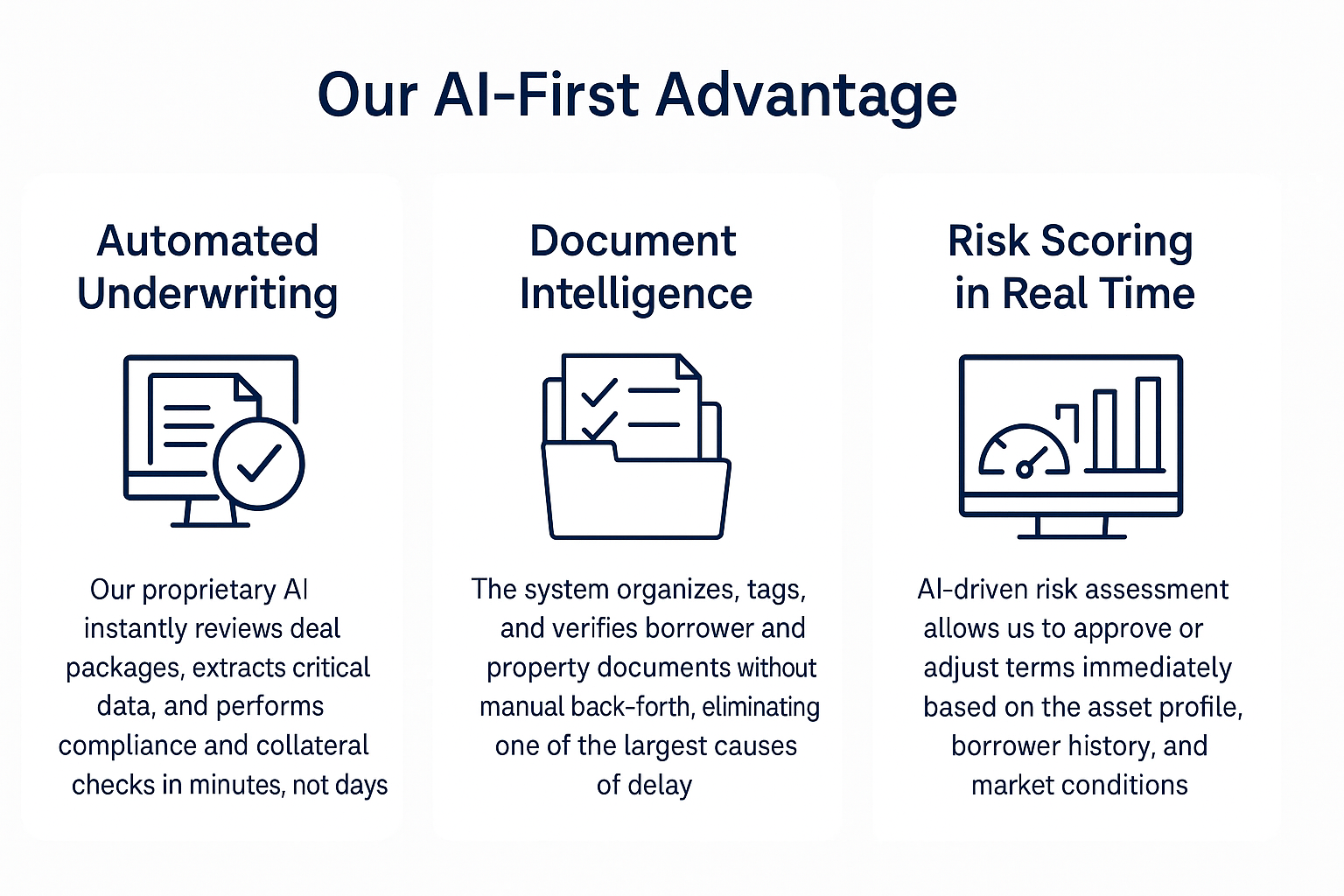

1. AI-Driven Underwriting

- Instantly parses borrower profiles, property details, rent rolls, and valuation reports.

- Detects red flags in real time—no waiting days for a human underwriter to spot them.

2. Smart Document Management

- Optical character recognition + NLP to extract and verify data from PDFs, images, and scans.

- Auto-tags and routes to legal and compliance without manual bottlenecks.

3. Parallel Workflows

- Legal, credit, appraisal, and funding teams work in sync from day one.

- Digital signature and remote closing remove travel and scheduling delays.

The Competitive Advantage of a 10-Day Close

- Win in Multiple Offer Situations – Sellers pick certainty over slightly better terms.

- Protect Against Market Swings – Close before rate changes or valuation shifts.

- Lock in Premium Assets – The best opportunities never make it to public listing.

Case Study: Dallas Multifamily, 2025

In September 2025, a $6.8M Dallas multifamily asset had three cash offers. The buyer chose our client because we could fund in 9 business days. Our AI engine pre-cleared underwriting in under 4 hours, while legal and funding ran in parallel. Deal closed 5 days before the rate lock expired.

Why AI Matters Here

Traditional lenders see AI as a “tool.” We built our entire closing model around AI—not just as an add-on, but as the operating system for every stage of the transaction. That’s why our 10-day timeline is predictable, not a lucky exception.

Your Next Deal Could Be Done Before the Competition Starts

Whether it’s a multifamily acquisition, a commercial refinance, or a bridge loan to seize a distressed asset, our speed can make the difference between owning the deal or losing it to someone faster.

Contact us to see how our 10-day closing process works on your next transaction.